The headlines appear every few weeks—Dallas-Fort Worth housing prices are among the fastest rising in the nation. Those who own homes probably feel pretty good about getting wealthier while going about their daily routines. Those trying to buy might feel a sense of panic as they watch a key part of the American Dream recede from their immediate grasp.

According to an index compiled by the Federal Reserve Bank of St. Louis, DFW housing prices have jumped nearly 18 percent since mid-2014. Among the nation’s 25 largest metropolitan statistical areas, DFW’s housing appreciation ranked fifth in this period, trailing only Denver (22.4 percent), Portland (21.1 percent), Seattle (19.5 percent), and San Francisco (19 percent).

Have we entered a new era in which DFW endures the same housing inflation as pricey San Francisco?

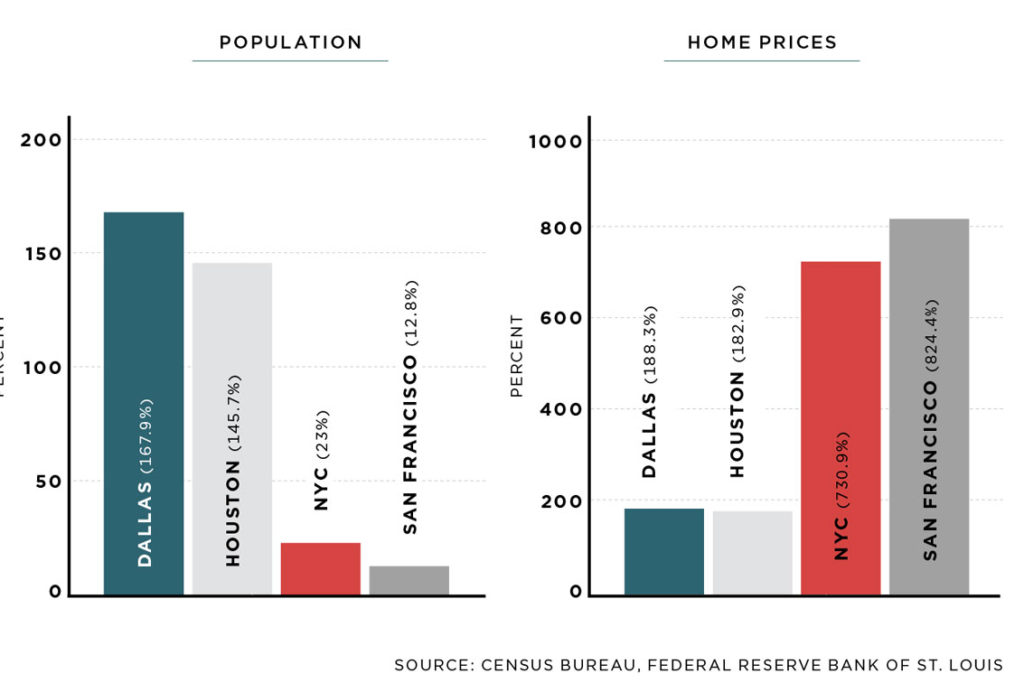

A longer view suggests that DFW housing remains affordable—at least compared to the other big metropolitan areas. According to the St. Louis Fed data, DFW housing prices rose 188 percent from 1980 through the first quarter of this year—an average of just over 5 percent a year. Among the 25 largest metros, only Houston and Detroit had smaller increases in housing prices (see charts on page 76). San Francisco stood atop the ranking at 824 percent, an average of 23 percent a year. Then came New York at 797 percent, Boston at 693 percent, and both Seattle and Los Angeles at 512 percent.

Predicting future prices is risky business—whether we’re talking about crude oil, credit, stocks, or houses. However, the basics of housing supply and demand suggest that DFW won’t end up with the crazy housing prices of San Francisco or New York.

Housing demand depends on such factors as population growth, household incomes, housing prices, apartment rents, mortgage interest rates, and the availability of credit. DFW stands out in population growth. Over the past decade, the region has added an average of 130,000 residents each year. According to projections, DFW’s population will surpass 9 million by 2030. So housing demand should stay strong, exerting upward pressure on prices.

Increasing demand doesn’t have to send housing prices soaring. Since 1980, Texas’ two biggest MSAs have been among the leaders in national population growth, with gains of 168 percent in DFW and 146 percent in Houston. Even with the flood of newcomers, increases in housing prices were modest over 35 years—188 percent in DFW, as previously noted, and 183 percent in Houston.

Now look at the East and West coasts. Since 1980, population grew just 23 percent in the New York City area and 13 percent in San Francisco (see chart). Despite the modest gains, the two areas had the biggest housing price spikes among the top 25 MSAs.

Response on the Supply Side

When an influx of new people boosts housing demand, market signals encourage new building activity in response to rising prices—so supply becomes key to keeping prices from spiraling out of control.

We’re certainly seeing that. Census Bureau data shows that DFW joined Orlando, Houston, and Charlotte as the four MSAs with more than 8,000 building permits per 1 million people in the past year. Among the top 25, MSAs at the top of the rankings had more than four times the permits as those at the bottom.

The top 25 MSAs differ in the composition of building activity as well as its pace. San Antonio, with less than half the permits of Texas’ two other big cities, has the highest share of single-family houses at 82.8 percent. Riverside, Calif. (78.7 percent) and Phoenix (74.2 percent) also skew toward single-family.

Houston leans toward single-family construction (64.6 percent). DFW is evenly split between apartments (49.2 percent) and stand-alone homes (50.8 percent). Multifamily building dominates in the New York area (87.1 percent), Los Angeles (75.2 percent), Miami (69.5 percent), Boston (67.8 percent), and San Diego (67.4 percent).

Residents’ tastes and preferences shape the mix between single- and multifamily construction. The pace of building also depends on anticipated population, land prices, building costs, and the availability and cost of construction loans.

Given time, markets should mitigate price shocks—but local regulations and red tape often short-circuit the market signals. To serve the interests of existing residents, MSAs routinely slap restrictions on land use and housing construction, impacting the cost of land and the pace of building. The interventions crimp new housing supply and let rising demand drive up prices as new households arrive looking for places to live.

The Wharton Residential Land Use Regulatory Index shows that DFW and Houston are among the nation’s freest property markets. The least-free MSAs are in the Northeast and the West Coast.

Heavy intervention in New York and San Francisco tells us why those MSAs—and others like them—see the cost of housing rising beyond what average households can afford. Freer markets in DFW and Houston help explain their relatively low housing prices in the face of the big population gains of the past three-plus decades.

Over those years, new construction has kept pace with exploding demand and blunted rising prices. Texans can expect the same in the future. DFW won’t continue to match San Francisco in the rate of housing-price increases.

Affordable Housing a Plus

A few years ago, we identified affordable housing prices as one of six key factors driving migration within the United States—most notably, families leaving California and New York for DFW and other places in Texas. Affordable housing acts like a magnet for migrants.

In another study, we showed that housing prices are key to a relatively low cost of living that helps make Texans better off in real terms. A dollar earned in Texas goes farther than one earned in most other states. Adjusting for cost-of-living and taxes, for example, gives Texas an average hourly wage of $17.63, well above California’s $15.01 and New York’s $14.66. Affordable housing contributes to higher living standards.

For the DFW and Texas economies, the cost of housing carries implications far beyond families building wealth and living the American Dream. The migration and cost-of-living data show that affordable housing has played an important role in the state’s economic success. It can continue to do so—if DFW and other areas keep the supply side of the housing market free.

Article Courtesy of D Magazine:

http://www.dmagazine.com/publications/d-ceo/2016/december/maintaining-the-dfw-housing-market/?utm_source=hs_email&utm_medium=email&utm_content=38927982&_hsenc=p2ANqtz--aNLzJNumR2nFCTFJ1pXKQkbhRNypI-gIgEBWH8Z8o1Q5BQGq_rUfsK_sHgpLfsJSysiBmsnkEU4r86lTlLDd8CZ9JLAoXTcBghQIZpbNkqD-0ns4&_hsmi=38927982

Print

Print